Opportunity knocks for UK dairy industry

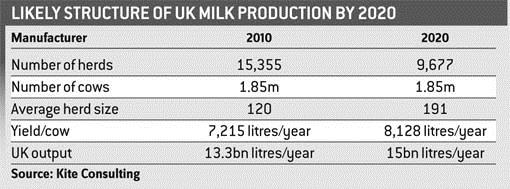

UK milk production could reach 15bn litres by 2020, an expansion of 13% on 2010. Current supply chain iniquities should not mask the opportunities that this offers, says Kite Consulting in its discussion document World Class Dairying – A vision for 2020.

Produced in response to the Dairy 2020 initiative, the paper describes an industry facing many challenges but also with potential for investment to take more UK milk into the growing world market as well as meeting higher domestic demand. It will be crucial for the supply chain to work together to maximise the opportunities, says Kite.

Farmers will need to choose markets and production systems carefully and excel at what they do, says the report. It also calls for better market focus, responsiveness and equity throughout the supply chain. That chain, including consumers, also needs to accept that farm level milk production must change, it says.

Risks for processors and retailers are also highlighted – restructuring will result in fewer and larger farms, while the expansion of export business would help to shift power away from domestic milk buyers. “Getting farmer relationships right or wrong will be more costly then than now in terms of milk volume gains or losses,” it warns.

Kite predicts volatile milk prices with a generally inflationary trend driven by retailer contracts linked to cost of production and by strong prices in world dairy markets as demand outstrips supply.

“If farmers can operate at or around global prices and learn to cope with the inevitable volatility then we believe dairy farming can be profitable enough to give farmers just rewards for their efforts and support re-investment and expansion,” it says.

“Current UK milk prices are below world market levels, although volatility means that the world price will be anywhere between 25p and 35p in the medium term,” says Kite consultant John Allen.

However, the price paid for milk needed to reflect production costs, re-investment needs and a worthwhile return for farmers.

If farmers do not get sufficient reward, they will simply do something else and we will export our dairy sector to other countries that may have fewer dairying skills, less focus on animal welfare and a higher carbon footprint, warns Kite.

“We are now in a very, very different environment and the wheel will simply go faster. The world we’re going into will be quite ruthless and competitive. The UK’s technical, welfare and climatic advantages are crucial in producing competitive milk,” says Mr Allen.

“Good business performance is essential and is intimately related to a high level of technical performance and in turn to higher welfare standards – it’s a virtuous circle.

“Dairy farmers are no longer hampered by the cost of quota and that is a great advantage. Banks are generally positive towards realistic expansion plans.

“Processor investment is needed closer to the big milk production areas, especially in the north. Processors also have to decide whether to invest in incentivising dairy farmers to produce a level profile of milk supply or in capacity to deal with the peaks in supply from block calving.”

Despite further producer consolidation, Kite sees the diversity of UK milk production increasing, in scale and in systems, ranging from low to high output, small herd to very large dairies and conventional through to organic systems.

These could all co-exist, rather than each claiming benefits for its own system over others, warned Mr Allen. “The market is big enough for all of them.”

Dairy 2020 facts

Launched in May this year, Dairy 2020 aims by November to produce recommendations for collective action by farmers, processors, retailers and policymakers to achieve a thriving, sustainable dairy industry in 2020.

First Milk, Volac, Asda, DairyCo, Dairy UK, the NFU, Defra and other farmer representatives make up a steering group, while a working group includes most of the main UK retailers, dairy farmers, manufacturers and groups such as the World Wildlife Fund and LEAF.

The project is managed by sustainable development charity Forum for the Future.

TOWARDS 2020 – KITE’S VIEW

* Producer numbers to fall 37% by 2020 – broadly in line with current trend

* Average yield to rise by 13% to 8,100 litres/cow/year by 2020 – relatively conservative compared with yield increases between 2001 and 2010* More price volatility

* Further contract development including more cost related, market related, fixed price, and perhaps formulae pricing

* Growing importance of strong co-operatives

* Lack of succession plans on farm will be a factor in falling producer numbers

* Increasing opportunities for producers to work together, whether dairy to dairy or dairy-arable arrangements.